sole proprietorship taxes malaysia

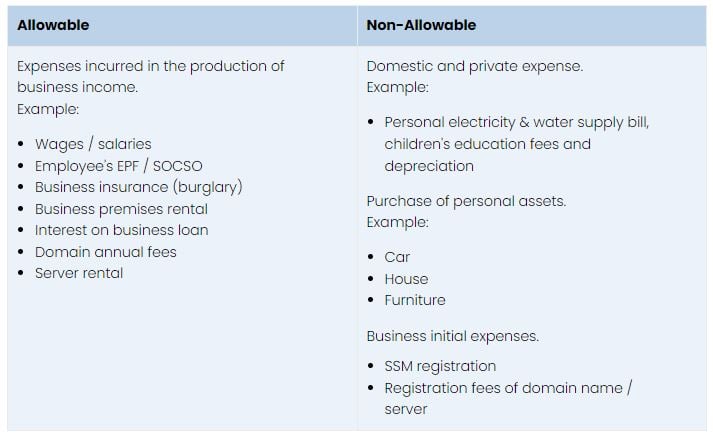

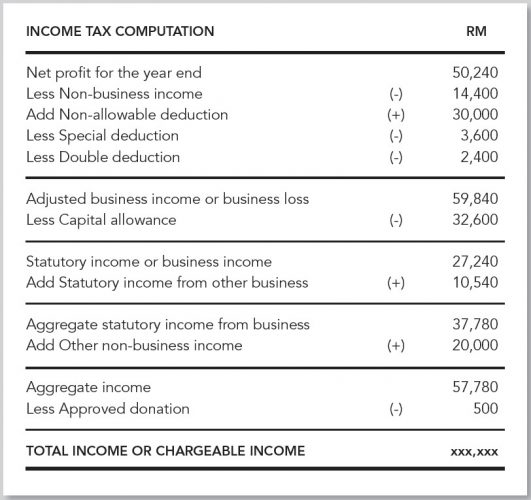

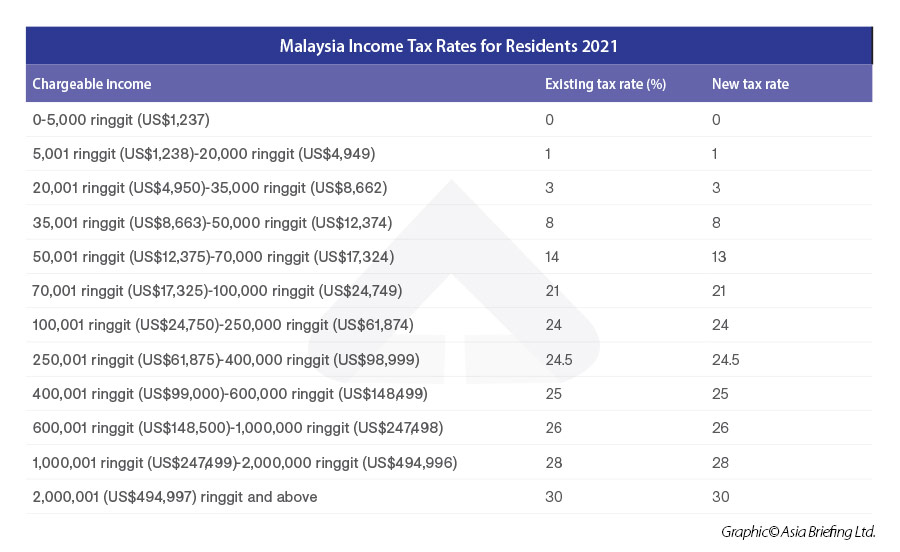

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. As mentioned a sole proprietorship will not be taxed separately for its owner.

:max_bytes(150000):strip_icc()/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)

Sole Proprietorship What It Is Pros Cons Examples Differences From An Llc

Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc.

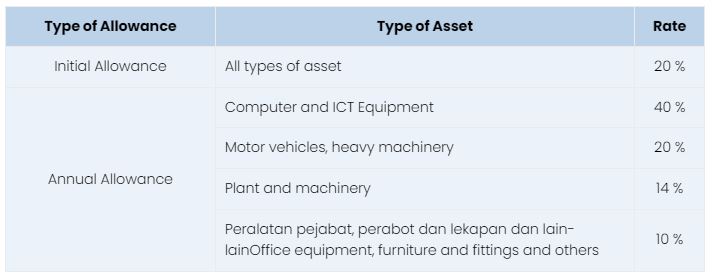

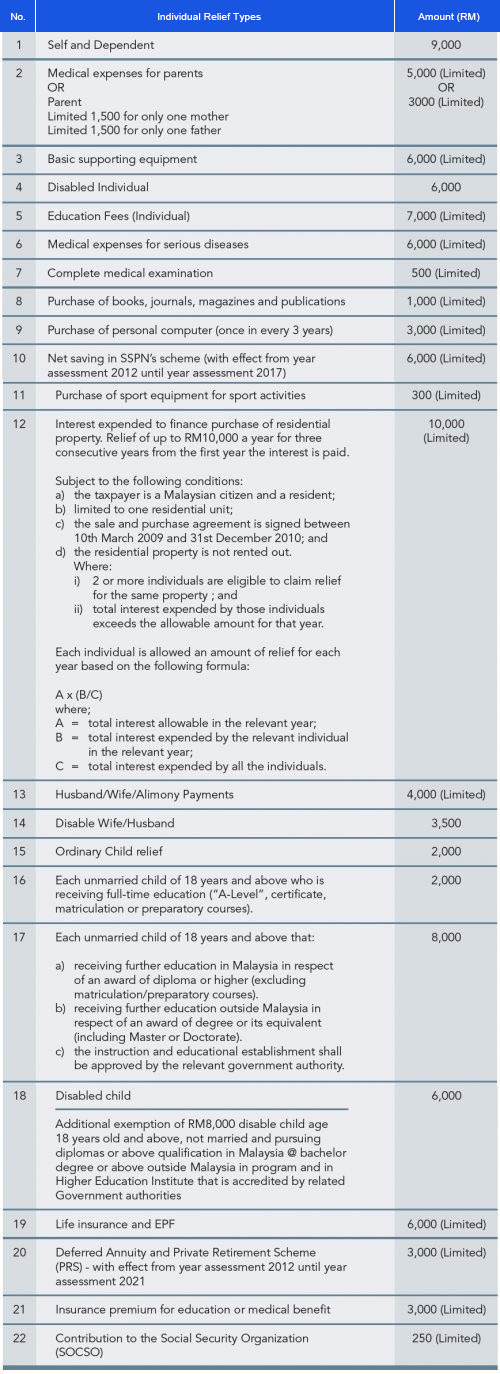

. Tax on LLP On the first 500K 20SME After 25. All business income received by the business owner must be declared in the personal tax filing. On the First 20000 Next 15000.

5 Steps On How To Set Up A Company In Malaysia. Full time employment is under Form BE. Next you must pay the annual fee to incorporate a sole proprietorship in Malaysia.

Companies are taxed at the 24 with effect from Year of Assessment 2016. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956. Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale.

Tax on Company On the first 500K 20SME After 25. A fee of RM60 every year if you register under a trading name A fee of RM30 every year if you use your personal name Also read. 18A 20 20A Jalan.

A sole proprietorship which uses the same personal name that is stated on your IC requires a registration fee of RM30. Owning a sole proprietorship gives the owner entire control and decision-making authority over the. A sole proprietorship also known as sole trader is a form of business operated by one individual.

On the First 5000 Next 15000. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. RM 3255 Maintenance Cost of Entity.

Tax on Partners Sole Proprietor. Sole Proprietorship Sdn Bhd. 1 For sole proprietary u shall do the tax filing by submit the Form B.

SOLE PROPRIETORSHIP Trade Name Registration Fee RM 6000 a year The business is owned by 1 individual PARTNERSHIP Trade Name Registration Fee RM 6000 a year Business is owned. Suruhanjaya Syarikat Malaysia SSM Companies Commission of Malaysia CCM where you register your LLP get its birth certificate and do your annual declarations. A sole proprietorship using a trading name has a registration fee of.

On the First 5000. Here are some of the primary benefits of setting up a sole proprietorship in. Income Tax Status Income Tax Rate.

In the case of sole proprietorship business chargeable income is his or her individual income. The annual charges are as follows. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives.

Both also taxable based on the.

Business Income Tax Malaysia Deadlines For 2021

5 Important Things To Know About Sole Proprietorship In Malaysia Trustmaven

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

How To File Income Tax For Your Side Business

Doing Business In The United States Federal Tax Issues Pwc

Sole Proprietorship Taxes Everything You Need To Know Nerdwallet

How Your Business Structure Affects Your U S Taxes Freshbooks Blog

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Understanding Tax Smeinfo Portal

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

Individual Income Tax Amendments In Malaysia For 2021

How To File Income Tax For Your Side Business

Format Computation Of Statutory Income For Sole Proprietorship Business For Ya Docx Computation Of Statutory Income For Business Sole Course Hero

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

:max_bytes(150000):strip_icc()/business-entities-3193420_final-9806a9e0701a4f60b9e06d36e0e0338b.png)

Comments

Post a Comment